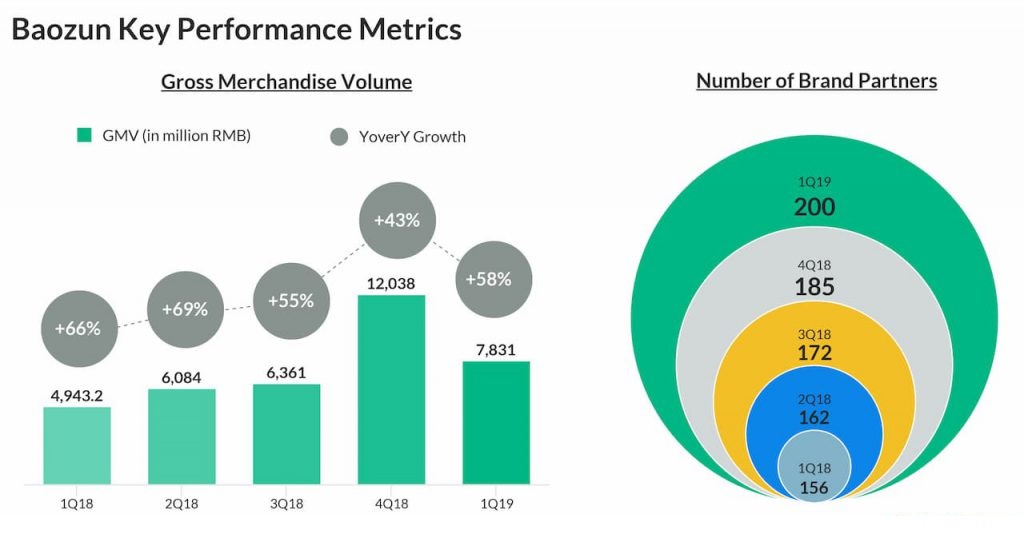

Technology companies continue to rise in China, as they cater to more people and deliver more value. Those companies are displaying good performance and rising in the digital sphere. One such company is Baozun, which is a large e-commerce solutions provider. They are very similar to the US company ‘Shopify’ in that they provide digital marketing, warehousing, and customer services. Both companies had their IPOs at very close dates, as well. The company (Baozun) helps its customers to connect their online stores with their physical stores to give their buyers a seamless shopping experience and enhance operations. The customers of Baozun are high profile companies, such as Nike, Levi, Microsoft, and others. Currently, Baozun has a customer base of at least 172 big brands.

Technology companies continue to rise in China, as they cater to more people and deliver more value. Those companies are displaying good performance and rising in the digital sphere. One such company is Baozun, which is a large e-commerce solutions provider. They are very similar to the US company ‘Shopify’ in that they provide digital marketing, warehousing, and customer services. Both companies had their IPOs at very close dates, as well. The company (Baozun) helps its customers to connect their online stores with their physical stores to give their buyers a seamless shopping experience and enhance operations. The customers of Baozun are high profile companies, such as Nike, Levi, Microsoft, and others. Currently, Baozun has a customer base of at least 172 big brands.

The company has had a market share of around 22% measured by transactions value in 2015, and this share is expected to be much larger today given the company’s consistent results. Baozun currently serves Chinese customers.

科技公司继续在中国崛起,因为它们迎合更多人并提供更多价值。其中一家公司就是宝尊,它是一家大型电子商务解决方案提供商,提供数字营销,仓储和客户服务。宝尊帮助其客户将他们的在线商店与他们的实体店连接起来,为他们的买家提供无缝的购物体验并增强运营。宝尊的客户是耐克,李维斯,微软等知名公司。目前,

Financial performance

Financial performance

Baozun’s stock has grown in price since 2016 from below 10 USD per share to over 40 USD. The stock is known to be volatile and may be challenging for short term traders, but it has consistently delivering when it comes to growth, often beating expectations. The company has a market capitalization of 2.461 billion USD as of August 7th, 2019. Its annual profit margin is 5 percent and it has healthy solvency with debt to assets ratio of 13.24%. A key positive factor about the company is that 2.4 percent of its shares are held by people inside the company. This helps keep those key stakeholders engaged and motivated to keep up a good performance and results.

财务表现

宝尊的股价自2016年以来已从每股10美元以下的价格上涨至超过40美元。众所周知,该股票不稳定,对短期交易者而言可能具有挑战性,但它在增长方面始终如一,并经常超出预期。

Most equity research companies are bullish about the stock

Most equity research companies are bullish about the stock

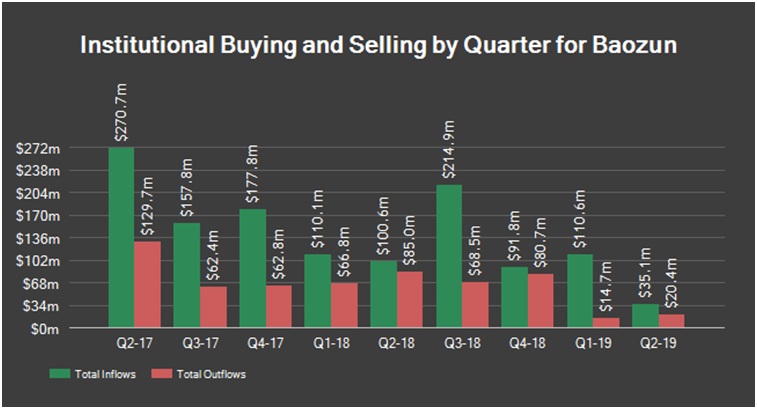

The prospects of the company’s stock are promising. Many research companies were positive about its future direction. Jefferies equity researchers changed the status of Baozun Inc. (NASDAQ: BZUN) shares to a “Buy” rating in their report published on August 5th, 2019. Credit Suisse also published their reports on BZUN shares, where they marked BZUN under “Outperform” rating, on July 17th, 2019. Additionally, BZUN shares got another “Buy” rating from CLSA. BofA/Merrill Initiated the “Buy” rating for BZUN shares, as published in the report on June 16th, 2015. Morgan Stanley also expects the stock to go up based on their forecasts. Furthermore, there seems to be high interest in the stock from institutional investors, who have been more channelling more capital into Baozun. Those investors usually have a long-time horizon, which adds to the optimism about the growth of the stock.

多数股票研究公司看好其股票

该公司股票的前景充满希望。许多研究公司对其未来发展方向持积极态度。 Jefferies股权研究人员在2019年8月5日发布的报告中将宝尊公司股票的地位改为“买入”评级。摩根士丹利还预计该股票将根据其预测上涨。此外,机构投资者对股票的兴趣似乎很高,他们将更多资金引入宝尊。这些投资者通常有一个长期的视野,这增加了对股票增长的乐观情绪。

Enhanced business model

Enhanced business model

Although the company focuses on digital solutions and IT infrastructure, its business model is better than the traditional model of an online marketplace. Baozun provides services that help clients integrate their operations both online and elsewhere. Even Alibaba, the major Chinese global platform believes in the viability of Baozun’s model and has invested in it. Alibaba integrates Baozun’s services into Tmall (a B2C online retail website) and Taobao (an e-commerce website).

The model Baozun uses has matured with time. It started as a distribution model, where it acquires products from sellers and sells and delivers them to buyers. However, now, it allows sellers to sell directly to customers. This has increased the gross merchandise volume going through its platform and led to higher revenues.

增长的商业模式

虽然该公司专注于数字解决方案和IT基础架构,但其商业模式优于传统的在线市场模式。宝尊提供的服务可以帮助客户在线和其他地方整合运营。

宝尊使用的模型随着时间的推移而成熟。它最初是一种分销模式,从卖方那里获得产品并进行销售并将其交付给买家。但是,现在,它允许卖家直接向客户销售。这增加了通过其平台的商品总量,并带来了更高的收入。

The ecommerce market

The ecommerce market

In general, Baozun works in a flourishing sector. The ecommerce market has been growing throughout the years with more people shopping and spending money online. In 2018, there were 649.9 million shoppers, whereas in 2019 it is estimated that there are (or will be) around 722.4 million shoppers. In 2022, the number of online shoppers is expected to reach 931.8.

Although those numbers are impressive, Baozun does provide a much wider range of services, including IT infrastructure and digital marketing services. This adds up to its growing revenues. Shareholders can expect decent returns, and even if the company, on rare occasions, delivered downbeat earnings, it was because of excessive investment. The strategy that the company follows is highly long term oriented.

电子商务市场

总的来说,宝尊处在一个繁荣的市场。多年来,随着越来越多的人在网上购物和花钱,电子商务市场一直在增长。2018年,有649.9百万购物者,而在2019年,估计有(或将来)约7.224亿购物者。到2022年,在线购物者的数量预计将达到931.8亿。

这些数字令人印象深刻,宝尊确实提供了广泛的服务,包括IT基础设施和数字营销服务。这不断增长了其收入。

Conclusion

Conclusion

Baozun is a remarkable company in the services sector, and it has been receiving adequate attention from investors and the media alike. Although the stock is a good investment over a long-time horizon, it may not be suitable to investors with a faint heart. It is characterized by high volatility, and thus speculators may find both opportunity and risk in it. The high-profile portfolio of clients the company has will enable it to weather economic storms should they occur. The big brands that rely on Baozun will guarantee a constant stream of demand. Since the company is focused on serving the Chinese market, it is currently relatively isolated from the effects of the trade war (although it may still be affected through supply chain disruptions). In the overall, all the factors seem to be pointing in favour of buying the stock, but prudence is advised.

宝尊是服务业的一个非凡公司,它一直受到投资者和媒体的充分关注。虽然股票在很长一段时间内是一项很好的投资,但它可能不适合短期的投资者。它的特点是波动性很大。由于该公司专注于服务中国市场,因此目前贸易战的影响相对较小(尽管它可能仍会受到供应链中断的影响)。总体而言,所有因素似乎都有利于买入其股票,但建议谨慎行事。