Online Giants Expanded Into Offline Locations

By Lesley Chai, Assistant Manager

近20年来,"黄金周"一直都是拉动内需和商业消费的"重要推手"。然而随着便捷线上支付平台在中国迅速普及,较低的劳动力成本使中国消费者得以享受高效率的快递服务,线下零售行业的发展在前几年似乎陷入停滞甚至倒退,即使"黄金周"内的销售量也无法与往日盛况相比。反观线上店铺的发展,虽然网店和电商的发展依然突飞猛进,但是电商格局基本已定,新的中小电商想要实现过去那样的井喷式增长和推广力度已非常困难,相对饱和的市场和店铺以及消费者相对固定的购买渠道使得电商的增长趋于稳定,竞争压力也更大。

近20年来,"黄金周"一直都是拉动内需和商业消费的"重要推手"。然而随着便捷线上支付平台在中国迅速普及,较低的劳动力成本使中国消费者得以享受高效率的快递服务,线下零售行业的发展在前几年似乎陷入停滞甚至倒退,即使"黄金周"内的销售量也无法与往日盛况相比。反观线上店铺的发展,虽然网店和电商的发展依然突飞猛进,但是电商格局基本已定,新的中小电商想要实现过去那样的井喷式增长和推广力度已非常困难,相对饱和的市场和店铺以及消费者相对固定的购买渠道使得电商的增长趋于稳定,竞争压力也更大。

在线上和线下都出现瓶颈之时,将双方结合反而可能成为一个突破口。我们可以看到,由互联网巨头打造的生鲜店正在各大城市扩张:阿里的“盒马鲜生”、京东的“7FRESH”、腾讯入股的“超级物种”等由通过线上线下融合的新零售模式近年来在满足消费者对生鲜食品采购、餐饮、美食以及生活休闲需求的探索上正逐步走向成熟。

区别于传统零售模式,“新零售”的最大特点便是能够利用科技和数据的力量,进一步提高用户的购买体验。随着科技、大数据应用、智能零售、移动支付和物流网络的发展壮大,中国的互联网巨头们正准备好统治零售超市领域。例如,“盒马鲜生”为顾客提供了在普通超市内难以购买的新鲜渔获,并专门为支付宝用户提供无现金支付的便捷体验,而“超级物中国“新零售”的快速发展,甚至值得全球零售地产的开发商和零售商学习和借鉴。仲量联行中国区研究部总监周志锋认为:“商场在中国早已颠覆了传统零售的含义,不再单纯是提供买卖商品服务的场所,民众可以在全新的体验式购物中心里从事多种多样的活动,如聚会用餐、社交、休闲娱乐、亲子教育等,体验各类新生事物,从而催生消费需求。”

In late 2016, Alibaba mentioned the concept of “new retail” which described traditional retail merging with the concept of online shopping, or traditional retail stores taking advantage of big data and new technology. Alibaba and their close competitors pushed into the new retail territory in 2017 and the result was some new grocery store brands and new cooperation models. Below we explore more about why traditional retail is of interest to these Internet giants and just how and why they are adopting these strategies.

Here are five reasons as to why online retail players or technology companies have started to expand into the offline retail business when most of them are doing well online -

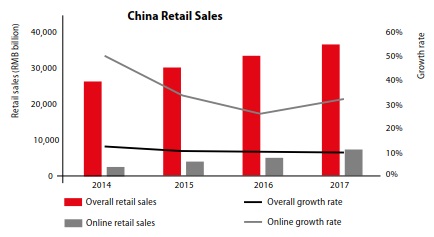

Source: China Statistics Bureau, JLL research

Source: China Statistics Bureau, JLL research

• Limited proportion of online retail and slowing online growth pushed online players to go offline to expand their market share.

It is true that online retail growth is much faster than offline retail growth. By 2017, online retail sales achieved an annual increase of 32.2%, higher than the overall retail sales growth at 10.2% y-o-y. However, online sales accounted for 19.6% of total retail sales, which means there is a larger offline retail market that online players could expand to meet. The slowing rate of increase in online retail sales from 49.7% in 2014 to 26.2% in 2016 also pushed online giants to find new ways to achieve fast development.

• Online customer base increased at a slower pace.

Based on Alibaba’s figures, growth rate of active buyers saw a large slow down from 5.4% by end-2015 to 0.9% by end-2016. As online users are nearly saturated, online companies would like to go offline to expand their customer base to support increase in sales.

• Format change in physical retail market makes it easier for online players to try offline business.

Take Tianjin as an example, five department stores closed in 2015 because of poor performance. The closures mainly resulted from competition posed by online retail and new large shopping malls. The shopping mall format gradually dominated the market as shopping malls have large retail space with high quality construction, as well as flexible management regarding tenant mix adjustment to follow market changes. Healthy development of the shopping mall format provides online giants with high-quality retail places for physical stores.

• Food and beverage demand continues to be strong.

Overall food and beverage demand is strong. However, the online retail model cannot meet the dine-out demand and it is difficult to change customer habits pertaining to purchasing fresh food offline. To fill the gap and try to cultivate an online fresh food purchase habit in shoppers, online players chose to open offline stores to provide better fresh food shopping experiences and dining places at the same time.

• It is a good way to add online payment users.

When shopping in offline stores, staff will encourage and train shoppers to download the app and use their own payment platform. Therefore, it can also make a profit on the growing online payment business.

Tencent has invested in a Chinese supermarket operator Yonghui, who opened Super Species supermarket chain while JD.com has 7Fresh, but probably the most popular new grocery store to emerge from an online retailer is Alibaba’s Hema Grocery store. By the end of 2017, they had reportedly opened 31 branches, mostly in Tier 1 cities. And in addition to the stores, each has their own branded grocery store app.

Super Species, Yonghui's supermarket

Main Players and Competitors on the New Retail Battlefield

Hema grocery store ranges from 3,000 to 5,000 sqm, which is similar to other boutique supermarkets such as blt and Ole Supermarket, and they are mainly located on the basement floor in shopping malls near a large residential catchment. However, Hema grocery store has a large, separate section as its warehouse space to store fresh food. Shoppers can see the conveyor belt on the ceiling and staff filling bags with goods from the shelves based on the lists generated by online ordering. After the staff has found all the goods on the order list, they put the bags on the conveyor belt and send them to the distribution centre for delivery to clients living within 3 km.

JD.Com Follows Alibaba To Launch Its Own Fresh Produce Supermarket 7Fresh

As most Tier I cities continue to witness a period of large retail supply, rent for a large space store on the basement level is relatively low. Compared to cold storage warehouses, which are always located in suburban areas and charge rents similar to those for retail space, Hema grocery store chain chose to put its warehouse space in each grocery store. They may save delivery time and cost, as the distance between the distribution centre and the client can be greatly reduced. Any concerns regarding supply chain management or how to estimate the storage of each food item can be solved using big data.

Hema grocery store chain encourages all its shoppers to download the Hema app onto their smartphones; use of the app enables people to order and pay via Ali’s related payment platform – Alipay – and supports business for other affiliates, including Ant Fortune, an investing app. By leading customers to become Alipay and Hema users, Hema not only enhances its financial business but can also build its customer data. Based on this database, Hema could calculate and estimate the storage of different types of goods in different stores, thus improving the efficiency of each physical store and reducing storage waste. Hema could also use the data to promote merchandise to individuals via the app after analysing their shopping preferences.

The grocery store chain, in addition to having its own Hema app, can also be accessed from the Taobao app, in an attempt to attract old Taobao users to this new grocery store chain.

You need an app to shop in Alibaba's grocery stores

Tianjin and Beyond

Tencent has signed a contract to open its Super Species supermarket in Tianjin’s Yanlord Riverside Plaza Phase IV, but we haven’t seen announcements from Hema or 7Fresh yet on any Tianjin locations. And while a few individual stores have reported profitability, it is too early to deem the online-to-offline “new retail” model a success. These new grocery stores may be a new better grocery model that are adopted and loved by consumers or they may just be a way to attract curious shoppers while there is abundant mall space and a way to help online platforms boost their image and connect with new customers. At any rate, we expect more new retail experiments to continue and look forward to seeing how these retail giants continue to shake up the retail market.