China’s Great Transformation

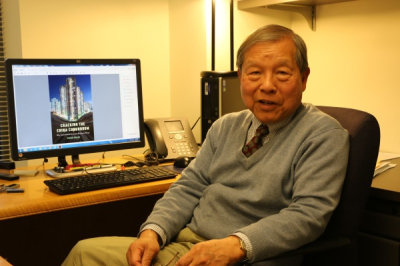

A conversation with Yukon Huang

Former World Bank’s Country Director for China

Senior fellow at the Carnegie Endowment for International Peace

By Mike Cormack

黄育川先生本科就读于耶鲁大学,后获得普林斯顿大学经济学博士学位,是卡内基国际和平基金会亚洲项目的高级研究员。加入卡内基前,他曾于1997年至2004年在北京担任世界银行中国业务局局长,此前于1992年至1997年担任俄罗斯及前苏联业务局局长。他的研究聚焦于中国的经济和金融发展及其对亚洲、美国、欧洲等地区的影响。他是世界银行团队的顾问,参与中国和世界银行“中国2030”这一关于中国长期战略的报告。另外,他曾任世界银行亚洲地区首席经济学家,并担任“国家援助战略”项目主管。他还曾在美国财政部任职,并在美国、坦桑尼亚和马来西亚的多所大学任教。

黄育川先生本科就读于耶鲁大学,后获得普林斯顿大学经济学博士学位,是卡内基国际和平基金会亚洲项目的高级研究员。加入卡内基前,他曾于1997年至2004年在北京担任世界银行中国业务局局长,此前于1992年至1997年担任俄罗斯及前苏联业务局局长。他的研究聚焦于中国的经济和金融发展及其对亚洲、美国、欧洲等地区的影响。他是世界银行团队的顾问,参与中国和世界银行“中国2030”这一关于中国长期战略的报告。另外,他曾任世界银行亚洲地区首席经济学家,并担任“国家援助战略”项目主管。他还曾在美国财政部任职,并在美国、坦桑尼亚和马来西亚的多所大学任教。

黄育川在有关中国和东亚的经济金融方面出版了大量作品。他的文章常常发表于主流媒体。他的著作有关于东亚地区未来的《东亚视野》,分析空间和经济因素如何塑造东亚增长模式的《重塑东亚经济地理》。

在黄育川先生的新书《破解中国之谜:为什么传统经济智慧是错的》(Cracking The China Conundrum:Why Conventional Economic Wisdom Is Wrong,2017)中,他详细解释了美国的贸易逆差和中国的顺差间并无直接因果关系:美国的赤字从上个世纪90年代后期到21世纪中期迅猛增长,然而中国在此期间并没有产生巨大的贸易盈余,因此中国不可能成为美国赤字的肇事者。

提及自己在中国生活时观察到的变化和改革,黄先生为我们娓娓道来。他说自己在很多国家都工作过,比如在俄罗斯、菲律宾、印度、孟加拉国和非洲等等,有很多的所见所闻,每个国家都有不同的社会体制和历史进程。从中他了解到一点,那就是每个国家在制定政策的时候都必须依据其本国的国情,所谓的“制度移植”是很危险的。 黄先生回忆,1997年,时任国家总理朱镕基是中国经济的掌舵者,出台了一系列的政治改革,比如将房产私有化,刺激了中国房地产工程建设的繁荣;他还出台各种政策,力主国企改革,要推进国企的经济效益。 他认为,过去几十年来,中国的改革开放是不同维度的,是全方位的。中国的经济实力能走到今天这样好的局面,是因为其经济政策本身在不停地演进,针对不同阶段的问题出台相对应的政策。对于很多人所说的“中国正在走向金融危机,房地产市场是一个巨大的泡沫”这种说法,黄先生认为中国在债务和房地产市场方面有很大的不同。最大的区别就在于中国人多,土地相对有限,过去十年中楼价飙升了600%使得70%的信贷进入房地产市场。黄先生认为这不是债务问题,实际上是金融深化。他在书中表明,今天中国的债务占GDP的比例实际上是正常的。

在这本书中,黄先生还提到Michael Pettis的说法:“增长可能会放缓至3-4%左右”,但实际增长为6.9%,就这一数据差异问题,黄先生解释说,我国的经济越来越以服务为导向,目前电商产业发展迅速。而GDP产值的数据中通常不计算数字经济产生的的份额,因为数字经济较难评估。所以GDP数字高低或不符并不是真正的问题。此外黄先生发现,中国的消费增长速度在过去的几十年里快于任何一个主要经济体。中国需要平衡增长模式的说法是错误的。

Yukon Huang is the author of “The China Conundrum: Why Conventional Economic Wisdom Is Wrong”, one of the finest books on Chinese economy yet published. With enormous experience from his time as the World Bank’s Country Director for China from 1997 to 2004, and for Russia and other Former Soviet Union Republics of Central Asia from 1992 to 1997, he is a genuine expert on developing economies and the issues in their transiton to more advanced technologies. He is now a senior fellow at the Carnegie Endowment for International Peace.

Did you focus on China during your studies?

Did you focus on China during your studies?

I’m a specialist in the economics of developing countries but not specfically on China. My PhD thesis was on Malaysia, focusing on agricultural issues in Malaysia - its transition to a country that has begun to use more technologically sophisticated agricultural processes. I then worked at the US Treasury covering Asia, and at that time ironically the focus was on Burma/Myanmar when it was closing down. The big issue was should the US engage in Myanmar or should we just give up on it? Subsequently the US gave up on Burma and of course it has come back within the last couple of years.

I then worked for the World Bank for almost three decades. Many of my assignments were in Asia but I was also posted in Russia for a while. So, I specialize in emerging market economies and China is one of the best examples.

What attracted you to this area of international development as compared to domestic economics?

My interest was always international. After I finished my thesis, and having taught at the University of Virginia, my first real assignment in some ways was in Africa. So, I went to Tanzania. I spent two years in Tanzania teaching economics and doing research on Africa Economic Development. Then I went to the US Treasury and I worked in Emerging Market Economies. Then I joined the World Bank, and essentially focused on emerging market economies. My last major assignment was China, though it turned out that China was completely different.

When you were the Country Director for China at the World Bank, what were your main priorities during that time?

I went to China in 1997, when Zhu Rongji was just taking over as a prime minister, and getting on with several major initiatives. One was WTO accession. What surprised me about WTO membership is that we all expected China’s trade balance to deteriorate, because China had to liberalize imports and lower tariffs. We thought that imports would surge, and it would take time for China’s exports to increase, so we expected China’s balance of payments to actually moderate or decline. But the reverse happened. China had huge trade surpluses. But what we did not forecast was the strength of the East Asia production sharing network in terms of using China as the base for exporting to Europe and the West. So, you have this huge surge of trade between China and Asian economies in parts and components, assembled in China and exported to the West, which led to a huge surge in exports. So that’s one thing that surprised me.

The other thing that surprised me was the strength of the private property market. In 1997-98, China started to privatize home ownership. People could buy their homes and sell them after a while, and this created a secondary housing market. Then, in 2004, China created auctions to develop land in major cities and made commercial development of both housing and commercial property a market process, and this became a major source of growth for a decade. I saw these two issues as important accomplishments, but underestimated personally how powerful they would be in transforming China.

Looking back at Western comment on the Chinese economy, there’s always a fear of looming recession, and these growth engines are almost entirely overlooked.

Looking back at Western comment on the Chinese economy, there’s always a fear of looming recession, and these growth engines are almost entirely overlooked.

It’s very easy to underestimate the power of efficiency gains from reforms and the power of what I call “collective action” in China. This is a system where, if they get it right, they can very quickly move forward in a unified fashion. It is very hard to estimate because we don’t have comparable examples in the West. The power of collective action and potential economic gains from certain reforms are much more powerful in China than what we have been able to see in other countries.

Most people would be surprised to learn about China’s low level of government expenditure – around 30% - as compared to about 45% for OECD members. Is this simply part of being a less developed economy, or is it a conscious decision?

China has more expenditure responsibilities than normal, but its budget is a very small share of GDP. This is a legacy of its central socialist system, where corporations carried out a lot of social responsibilities paid for from their profits. Comparatively, now you have a much smaller state sector and a much larger private sector, but the economy is not securing tax revenues to build roads, healthcare, and education expenditure, all of which is needed.

China’s tax revenue is a relatively small percentage of GDP, around 32%, whereas the average for middle income developing countries is around 38%. So how has China been able to finance its public expenditure? The answer is: banks. Local governments borrow from banks to fund infrastructure. In my book I say “There is a problem in China but it’s not a banking or financial problem, it’s a budget problem, which creates what I call hidden fiscal deficits, and over time this needs to be addressed.”

In the book, you reference Michael Pettis’ claims that growth might slow to about 3-4%. We’re seeing growth actually accelerate to 6.9%, but people are claiming that the data must be incorrect, because it’s so consistent. Why is that?

In the book, you reference Michael Pettis’ claims that growth might slow to about 3-4%. We’re seeing growth actually accelerate to 6.9%, but people are claiming that the data must be incorrect, because it’s so consistent. Why is that?

Previously, people looked at indicators like energy consumption, and said energy growth is only increasing by 1-2%, so how can GDP be increasing by 8-10%? The answer of course is that China’s economy is becoming much more services oriented, so energy is less of an issue. Now services account for the majority of growth in China, and a lot of this is showing up in terms of e-commerce and certain services which are very hard to actually record in GDP. A big issue globally is how GDP is underestimated because the digital economy is harder to evaluate, and this is happening even faster in China. Here’s a country which has moved almost totally to an e-commerce payment system where everyone pays by phone and no one uses credit cards or cash anymore. GDP numbers don’t capture this.

The second thing is that China’s GDP accounts still have what I call vestiges of a country in the socialist era, when services and private activity were insignificant, so growth in informal activities, particularly in services, are not adequately accounted for. But every 5-7 years, China does a so-called re-basing of its GDP. Officials from the UN, the World Bank and the IMF come in, look at all the databases and re-calibrate GDP. Every time they do it, they find that the GDP numbers are too low. So in my book I talk about how data is not the real issue.

As for the argument that China’s GDP growth will collapse to 3% or thereabouts - there are two arguments that people make. One is that there will be a debt crisis. As I say, the economy is not going to have a debt crisis, but it does have a fiscal problem. The fiscal problem is bleeding the economy and needs to be dealt with, but it would take many many years before a collapse happens. Pettis’ argument is that consumption’s share of GDP is too low and must rise. But for it to rise, either consumption has to increase very rapidly or GDP has to fall. But consumption cannot grow so rapidly, though it’s already growing by 8-9% a year. Pettis argues that for consumption to be 43-45% of GDP ten years from now (currently it’s about 37-38%), GDP growth must only be 3%. If consumption grows at 5-6% and GDP grows at 3-4% then consumption’s share of GDP rises. But if GDP growth falls to 3%, incomes will fall and consumption will also fall. So in my book I point out that this is just analytically illogical.

What are the ideological biases you think that get in the way of discussing the Chinese economy?

What are the ideological biases you think that get in the way of discussing the Chinese economy?

China is difficult to analyze from the perspective of Western textbooks. The problem in China is that the state is heavily involved in the economy. Local governments in China are also economic entities - they invest, develop, and compete. We don’t have that in our textbooks in the West; there’s no concept of an economy in which the State is a competitive player. Then you have another problem: here’s a country that grew at 10% a year for three decades yet lacked strong institutions and had all sorts of weaknesses. Our textbooks would say that such a country cannot grow or develop very well. Many critics therefore basically say that there’s something wrong here. That’s why in my book I have an annex that shows GDP data in China actually understates China’s growth.

Ten years ago, the criticism was that China’s growth model was unbalanced. It consumed too little and saved too much, and that this would eventually lead to a crash. But I found that consumption growth in China has multiplied faster than in any major economy over the last several decades. The recommendation that China needs to balance and consume more is just technically wrong. What I basically show is that high performing economies - if they’re able to invest productively for long periods of time - will grow very rapidly, and consumption will also increase very rapidly. So that’s one fallacy.

The other thing was the growth of debt. People have been saying “This country’s heading for a financial crisis, it’s going to collapse, and its property market is a huge bubble.” I basically point out that China is quite different in terms of debt and the property market. The big difference is that a decade and a half ago it didn’t have a private property market and was struggling to figure out the price of land and property. But China has a lot of people, and relatively limited land, so property prices have soared by 600% in the last ten years and 70% of credit has been going into the property market. I argue in my book that this is not actually a normal debt problem, or a normal credit problem - it’s actually financial deepening. You are trying to find the value of an asset whose value was hidden in the centrally planned days. I basically show that today the debt to GDP ratio in China is actually normal.

In your chapter on the global balance of power, you discuss various confidence building measures and greater openness between the US and China.

In terms of global power relations, China is not easy to characterize. Recently, the Trump administration said China is a strategic competitor, not a strategic partner. I think this is bascially correct, so the question is how do you deal with this? I call China an ‘abnormal economic power’ – it’s not what we’ve seen before in the rise of a great power.

China is the first developing country to become a great power. It is also getting old before it gets rich, and its political class is not as sophisticated as you expect. It’s also the first great power which is a returning great power. This is all very unusual.

The concept of a so-called abnormal great power has two significant points. There’s a sense of insecurity in the system, and there’s also a lack of experience or sophistication. The West has quite some difficulty dealing with this. At the same time Xi Jinping has moved away from the guidelines that Deng Xiaoping had put in place - that China should bide its time, shouldn’t get involved in foreign policy issues in any kind of aggressive way, and just concentrate on internal matters. Xi Jinping has changed that: he's saying China is the second largest economy in the world, and very soon it’ll be the largest, so we need to express our views, and should be respected as a rising power. But they have never been really clear on the issues. What do they want to do that would be different? I think the issue is that it has not sorted out what its longer-term objectives are.